Debt collection is not a pleasant task and it is often put on the back burner by small enterprises. Much effort is focused on making sales, and bringing in new clients, yet only a fraction of that effort is actually put into recovering the whole point of the sale – the payment.

At the end of the day, businesses operate to make money, and if a business is not collecting that money it is simply accruing debt. This can place considerable drag on resources and costs your business even more money.

Many business people simply don’t expect the devastating and far-reaching consequences that poor debt recovery service will have on their livelihood. What may start out as a minor shortfall in cash, can eventually snowball into serious financial trouble culminating in complete failure of the business?

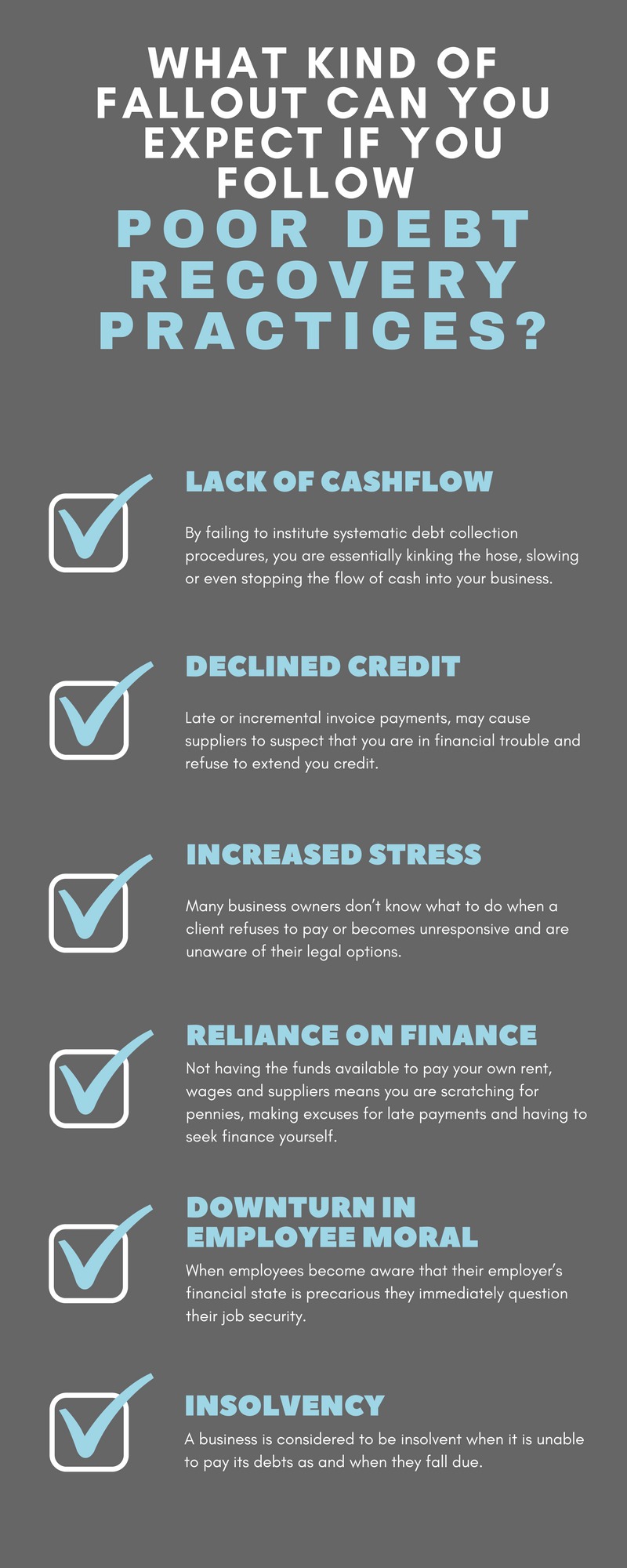

What kind of fallout can you expect if you follow poor debt recovery practices?

Lack of cashflow

Obviously, your business will be hardest hit in the back pocket. By failing to institute systematic debt collection procedures, you are essentially kinking the hose, slowing or even stopping the flow of cash into your business. This eventually makes just simple day to day business impossible, let alone expansion or growth.

Declined credit

Late or incremental invoice payments, may cause suppliers to suspect that you are in financial trouble and refuse to extend you credit. This usually means that any orders you place must be paid C.O.D. only.

Increased stress

Business cashflow is largely in the hands of your debtors and is to an extent outside your control. For this reason, when cashflow drops, stress levels can go through the roof. Many business owners don’t know what to do when a client refuses to pay or becomes unresponsive and are unaware of their legal options. They feel their hands are tied and that they are at the mercy of their debtors.

Reliance on Finance

Not having the funds available to pay your own rent, wages and suppliers mean you are scratching for pennies, making excuses for late payments and having to seek finance yourself. Meanwhile, lenders are often unwilling to lend to businesses that don’t have proven cash flow, as they present too much risk.

Downturn in employee moral

The impact of a business owner’s stress on his or her employees cannot be overstated. When employees become aware that their employer’s financial state is precarious they immediately question their job security. The result is that employee stress levels rise proportionately and job confidence, satisfaction and morale plummet. Some may even start looking for new work and pre-emptively quit for more secure employment, leaving you to recruit and train new staff on top of existing financial dramas.

Insolvency

There’s no avoiding it, if the deficit between incomings and outgoings is allowed to continue growing, your business will eventually face insolvency. A business is considered to be insolvent when it is unable to pay its debts as and when they fall due. Failing to respond to a bankruptcy notice or statutory demand is considered proof that your business is insolvent and generally results in assets being seized or compulsory bankruptcy or winding up proceedings being commenced. Both corporate and personal insolvency can have long lasting effects on a person’s credit and may restrict their ability to conduct business in the future.

The good news is, it doesn’t have to be this way, and business owners don’t need to live with the stress of cashflow shortfalls due to late invoice payments. There are effective methods that can be used by businesses to get clients to pay on time. Professional assistance can also be sought to optimise debt collection procedures to maximise realisation. The important thing is that debt recovery is given the priority it deserves, as a critical business function.